The GBP/JPY currency pair has long been a focal point for forex traders due to its unique blend of volatility and opportunity. This cross-currency pair, representing the British pound and Japanese yen, is often highly responsive to a broad range of economic and geopolitical factors. With the United Kingdom’s departure from the European Union—a seismic shift in global economics—the volatility of the GBP/JPY pair has been amplified in a post-Brexit macro landscape.

Understanding the Dynamics of GBP/JPY

The GBP/JPY pair is shaped by a complex interplay of economic forces from both the UK and Japan. Post-Brexit, the UK faces ongoing uncertainty due to shifting trade policies, labour shortages, and evolving regulations, all of which weigh on the pound. The Bank of England’s monetary policy decisions—particularly changes in interest rates—are key drivers of GBP value, offering crucial signals for traders.

On the other side, Japan’s economy remains rooted in low inflation and slow growth, with the Bank of Japan maintaining ultra-loose policies and negative interest rates. The yen’s reputation as a safe-haven currency means global instability can trigger sharp shifts in GBP/JPY. Broader geopolitical events, from trade disputes to central bank actions worldwide, further amplify the pair’s volatility, making it highly sensitive to both regional and global developments.

For more in-depth analysis and strategies, visit this link.

Key Post-Brexit Challenges Impacting GBP/JPY

Brexit has introduced lasting trade and regulatory uncertainty for the UK, disrupting commerce and delaying key trade deals outside the EU—factors that continue to pressure the pound. Domestically, economic shifts such as labour shortages, rising inflation, and weakened consumer confidence have created a fragile environment that fuels GBP volatility.

Investor sentiment remains sensitive, with ongoing concerns about the UK’s post-Brexit trajectory and political stability. These concerns frequently lead to sharp moves in GBP/JPY, as traders react to both economic data and shifting market outlooks.

Analyzing GBP/JPY Volatility Patterns

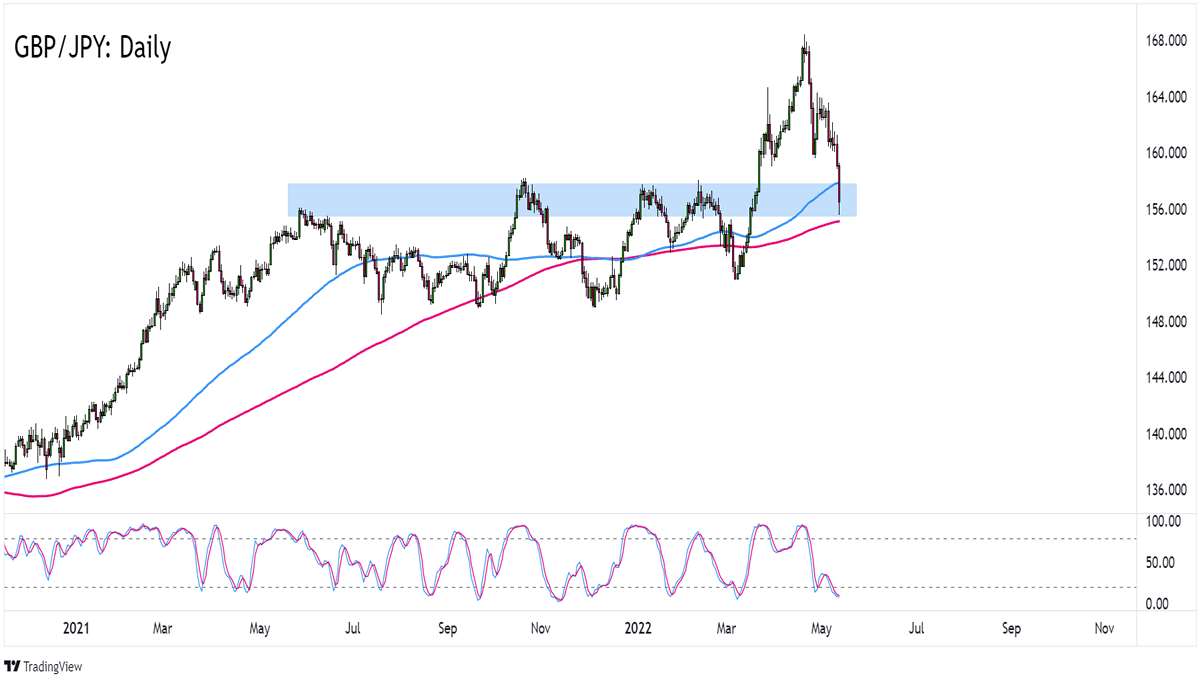

Since the Brexit vote, GBP/JPY has experienced sharp and recurring volatility. The initial shock saw the pound plunge to multi-decade lows against the yen, followed by turbulent swings during key events like UK general elections and trade negotiations. Each major political development, especially during Brexit talks, triggered noticeable price fluctuations as traders reacted to changes in the UK’s economic outlook.

Market conditions also influence volatility. In low-liquidity environments or during global uncertainty, GBP/JPY can move dramatically. Risk sentiment plays a major role—when investors seek safety, the yen strengthens, pulling the pair lower; when confidence returns, the pound often gains, pushing the pair higher. These patterns make GBP/JPY a particularly responsive pair to both domestic and global shifts.

Key Macro Indicators to Watch for GBP/JPY Traders

Key UK economic indicators include GDP growth, inflation, retail sales, and unemployment figures. These reports provide essential insights into the health of the British economy and can cause significant fluctuations in GBP/JPY. For instance, a stronger-than-expected GDP print or a rise in inflation could prompt the BoE to adjust its monetary policy, affecting the pound’s value.

Japanese Economic Indicators

Japanese economic reports, such as GDP growth, consumer spending, and inflation, offer a view into the strength of the Japanese economy. The BoJ’s policy decisions, particularly around interest rates and asset purchases, also play a critical role in determining the value of the yen. Since the BoJ has a history of employing aggressive monetary policy tools, shifts in these measures can have a direct impact on GBP/JPY volatility.

Geopolitical Risk Factors

Geopolitical tensions or events that impact global markets—such as conflicts in the Middle East, US-China trade relations, or changes in the US Federal Reserve’s policy stance—can cause sharp movements in GBP/JPY. Traders need to stay informed on such events and consider their potential impact on both the UK and Japanese economies.

Risk-Off vs. Risk-On Sentiment

Shifts between risk-on and risk-off sentiment in global markets are key drivers of GBP/JPY movements. When investors become more risk-averse, they tend to flock to the Japanese yen, known for its safe-haven status. Conversely, in risk-on environments, the pound may benefit as investors look for higher returns, strengthening GBP relative to the yen.

Trading Strategies for Navigating GBP/JPY Volatility

Navigating the sharp movements of GBP/JPY requires a balanced approach combining risk control and market insight. Effective risk management—through stop-loss orders, careful position sizing, and diversification—is vital to protect against sudden price swings. Technical analysis tools like moving averages, RSI, and Bollinger Bands can help identify entry and exit points, especially when paired with sound risk protocols.

Traders should also incorporate fundamental analysis to assess the impact of UK and Japanese economic data, interest rate changes, and monetary policy decisions. Additionally, monitoring market sentiment and reacting swiftly to news, particularly around Brexit or central bank announcements, can provide an edge in managing short-term volatility.

Conclusion

The GBP/JPY currency pair is highly volatile in the post-Brexit macro landscape, driven by factors such as the UK’s evolving economic situation, Japan’s deflationary policies, and global geopolitical risks. By understanding the dynamics at play, traders can develop informed strategies to navigate this volatility. Whether through careful risk management, technical analysis, or staying up-to-date on key economic indicators, successful traders can leverage GBP/JPY volatility for profit.